Welcome investors and traders! welcome to our Forex trading Signal and Analysis Site! TPwithUS signals and analysis are based on Price actions, Gann Angels, and Astrology! Here we share, the economic events of last week April 1st to 5th 2024. Stay with us and take profit with us in the forex trading Market together!

Summary of Economic events of last week April 1st to 5th 2024

The US calendar was packed with high-profile events, with jobs data updates and trade sentiment reflected across major currencies. But it was the Australian dollar and the New Zealand dollar that took the top spot this week, likely due to a positive PMI update from China and a midweek weakening of the US dollar.

U.S. dollar

The US economic calendar was busier than ever this week (surveys, jobs numbers, Fed members’ speeches) and it was a whirlwind for the US dollar.

Currency pairs linked to the US dollar

Economic events of last week April 1st to 5th 2024

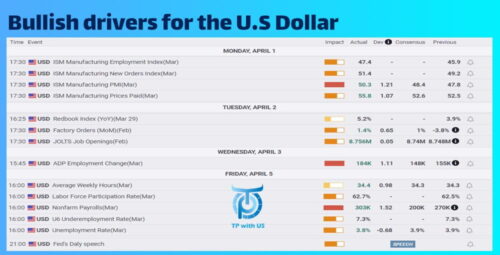

On Monday, manufacturing sentiment data came out surprisingly strong and the US dollar made small gains. And it creates the mindset that, “Hey, the economy isn’t too bad – there’s no need to cut interest rates!”

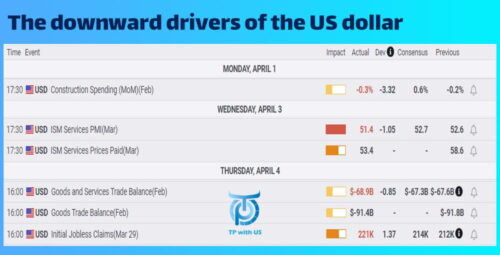

But on Wednesday, data on services sentiment came out and found that things were not so bad in the largest part of the economy. The ISM-PMI employment component remained stagnant, and inflation eased… The dollar essentially went into full bearish mode, losing value.

Thursday brought a glimmer of hope for dollar buyers. Minneapolis Federal Reserve Bank President Neil Keshkari hinted that they might not cut interest rates if deflation stalls, prompting the dollar to recoup some of its losses.

On Friday, the NFP jobs report was released. The job market is officially hotter than expected, and the dollar shot up like a rocket… only to crash and fall just as fast as it rose.

The classic dollar keeps us surprised that it reversed without a clear trigger, keeping the dollar as a loser for the weekend.

Bullish drivers for the dollar

On Wednesday, Atlanta Federal Reserve Bank President Rafael Bostic (of this year’s Fed rate policy voter) reiterated his expectation for just one rate cut this year, possibly in the fourth quarter of 2024.

On Thursday, Philadelphia Federal Reserve President Patrick Harker said inflation remains very high

Minneapolis Federal Reserve Bank President Neil Keshkari said on Thursday that if inflation stops, there may not be a need to cut rates.

On Friday, Dallas Federal Reserve Bank President Lori Logan said it was too early to consider a rate cut.

Richmond Federal Reserve Bank President Thomas Barkin (one of the Fed’s rate policy voters this year) said the jobs data was very strong.

The downward drivers of the US dollar

On Tuesday, Meister (one of this year’s voters on Fed interest rate policy), the president of the Cleveland Fed, said he still sees interest rate cuts in 2024, but not in May.

Thanks for reading the Economic events of last week April 1st to 5th 2024 with us, Be informed by the TPwithUS team, and take profit with us in the Forex market.

Follow TPwithUS Tradingview

https://www.tradingview.com/u/takeprofitwithus/

All about Market🥇

Trading Tips💡

Secrets of Astrology🔑

Analysis based on Gan📊

Take your profits with our free signals and news: t.me/TPwithUS

To take your profits with our VIP signals, contact: t.me/TPwithUSbot